Calculate your exact CPP benefit in seconds.

The Canada Pension Plan is a significant source of retirement income. Deciding when to start your benefits can be a difficult decision.

This Canada Pension Plan Calculator will quickly import your Statement of Contributions to provide you with how much income you can expect depending on which age you start your CPP benefits.

How to accurately calculate your CPP benefits

Calculating your CPP is complicated.

Your monthly amount received depends on when you start receiving your CPP benefit and decades worth of contributions that you have made.

The only way to accurately calculate your benefits is to take your pensionable earnings for each year, bring them into today’s dollars (Average Yearly Monthly Pensionable Earnings) and drop out the years to which you are entitled. You will need to do this for every possible age you may start your benefits from 60 to 70. Not only is this time consuming and overwhelming but human error can make the calculations inaccurate. It also would not include the formulas for the CPP Enhancements introduced in 2019 as this calculator does.

Use the CPP Calculator

This CPP Calculator is a simple and highly accurate way to calculate your Canada Pension Plan benefit. You upload your CPP Earnings and Contributions statement from your My Service Canada Account. It will automatically take the values from the statement and allow you to customize the values for future years to reflect employment earnings and future CPP contributions.

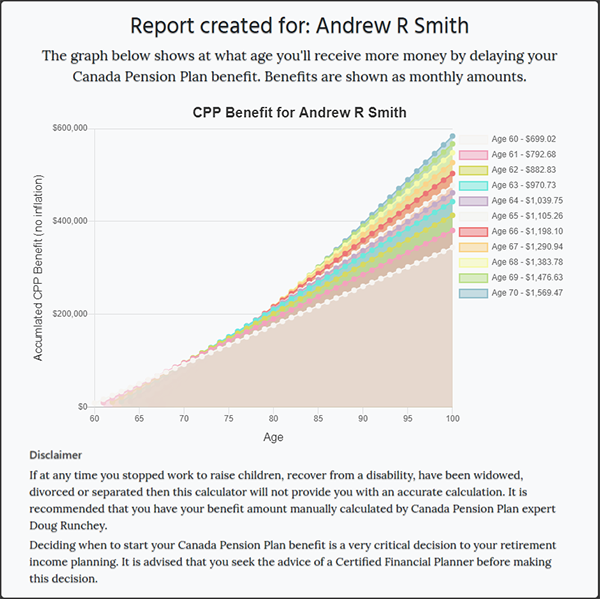

In seconds, the calculator will return your CPP benefit at each age you could possibly start your benefit. It will also display a graph to help you identify what starting age is most financially advantageous to you based on how long you think you’ll live.

The CPP Calculator makes thousands of calculations in order to provide you with the most accurate estimate of your CPP benefit at every possible age of eligibility. Providing us with your email before using the calculator allows us to ensure Canadians wanting to have these calculations done have access to the tool without having spambots reduce the speed of the calculations or overrun the resources of the servers making the calculator unable for you to use when you need it.

The Canada Pension Plan legislation

The Canada Pension Plan legislation is 251 pages, with two-thirds of that dealing with how the benefit is calculated under different circumstances. It is a very difficult document to read and interpret. Also, most of the figures used are from 1985, so figures such as the Year’s Maximum Pensionable Earnings for more recent times need to be used and substituted for the formulas in the pension legislation.

Pay for Doug Runchey’s help

Other than the cryptic CPP benefit formula laid out in legislation, there has been only one place to turn for highly accurate Canada Pension Plan benefit calculations: Doug Runchey.

Doug worked for more than 32 years for the Income Security Programs branch of Human Resources and Skills Development Canada. He was a specialist in the Canada Pension Plan and Old Age Security legislation, regulations and policy.

This CPP Calculator is based on Doug’s formulas and Doug has actively developed and tested this calculator.

Doug is available to accurately calculate your CPP benefit based on the Child-rearing dropout provision, CPP credit-splitting, or CPP audits. For calculations with the CPP enhancements included, the CPP Calculator will provide the same result as if you hired Doug to make the calculations.

Why you must calculate your CPP benefits

CPP benefits are taxable income

By design, the Canada Pension Plan is intended to provide you with approximately 25 per cent of your retirement income. It is a significant source of income in retirement and a form of savings you have paid into for decades.

All income you receive from the Canada Pension Plan is fully taxable and adds to your net income when you file taxes. The net income section on your taxes is used to determine the amount of Guaranteed Income Supplement and Old Age Security you will receive for the following 12 months.

Knowing how much you’ll receive will impact all your retirement income decisions. If you have any money saved in RRSPs, TFSAs or other savings and pensions your CPP start date will impact all other decisions you will make with these other retirement incomes.

Income Guaranteed for Life

The Canada Pension Plan benefit is guaranteed for your entire life. It amounts to hundreds of thousands of dollars by the time you would reach age 80. Choosing to start your benefit too early or even too late could cost you thousands of dollars.

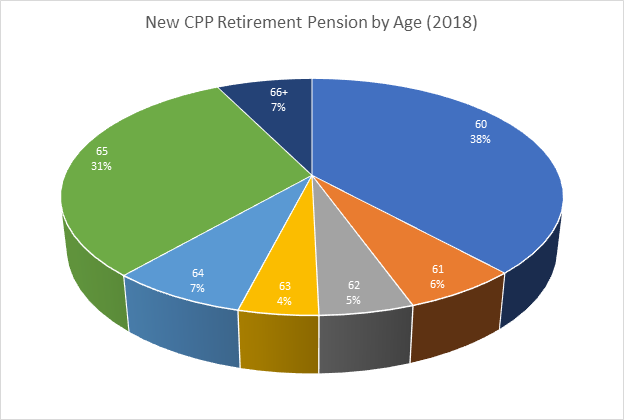

In 2018, 38 percent of Canadians starting their Canada Pension Plan benefit did so at age 60, while 31 percent were 65. Despite an opportunity increase the overall benefit by up to 42 percent, only 7 percent were age 66 or older.

Given average life expectancy, there are many Canadians not choosing the optimal age to start their CPP benefit. The right start date is based on many factors that are specific to you—and the CPP Calculator will help you understand your specific benefit amount at any start age to help you make this important decision.

The CPP Statement is not completely accurate

The Statement of Contributions will provide a CPP benefit estimate based on you starting your benefit at age 65. It also assumes that you are 65 as of the time of receiving the Statement of Contributions. It is unable to show the impact of taking the benefit early or waiting. If you continue to work, it will not properly reflect your additional contributions to the Canada Pension Plan and adjust your benefit projection.

“These estimates are very accurate if you’ll be eligible for your CPP retirement pension in the next few years,” says CPP expert and co-creator of the CPP Calculator Doug Runchey. “Otherwise, they can be misleading, especially if your future earnings will be significantly higher or lower than your previous average lifetime earnings.”

Other CPP calculators are not precise

There are other CPP calculators available. However, any calculator that does not use approximately 47 years worth of your exact pensionable earnings will not produce anything but a general estimate of your benefit. All those years are needed in order to help you use exact benefit amounts to make one of your most important retirement decisions.

This CPP Calculator provides a very accurate estimate, often to the penny. It also provides an easy way to upload your Statement of Contributions that allows you to get 11 years of benefit calculations in seconds and significantly reduces the risk of input error of your pensionable earnings.

Understanding how CPP benefits are calculated

Your Canada Pension Plan benefit is determined by your benefit start date, years of contributions and the elaborate formula laid out by the Canada Pension Plan legislation.

Every benefit start year must be individually calculated

The standard year to start your CPP benefit is at your age 65. You receive the most months to drop out at this age. The more you can drop out, the higher your benefit will be.

Well, every year you take the benefit earlier than 65, you’ll have less months overall to drop out. Depending on how high your contributions have been to the CPP, this could reduce your benefit amount. In addition, because you are starting your benefit early, you’ll receive a 7.2 percent reduction for each premature year.

However, if you stop working and making contributions to the CPP before age 65, every year will count as a zero-contribution year. Even though waiting to start your benefit may provide more drop out months, it will not add enough months to make up for the 12 plus months of zero contributions.

That is why a customized calculation such as that done by this CPP Calculator is so important. What might be right for someone else, may not match your individual or family circumstances.

You are dropping out months and not years

If you start your benefits at age 65, you’ll receive 96 months that you can use to drop out. That means dropping your lowest 96 months of 564 months of contributions.

Starting at age 60 will drop out 86 months of 504 months of contributions.

We’ve spent thousands of hours understanding this and doing these eleven times to calculate your benefit for every age is still daunting.